A fully integrated plug-and-play Acquirer platform

White-label payment gateway and Acquirer processing services—all under one provider. Create MIDs and TIDs independently, without interaction with the processor’s team.

Acquirer-as-a-Platform

We handle white-label acquiring software customization, deployment, and maintenance. You only need to pay a monthly infrastructure fee.

Utilize private AWS cloud with PCI DSS Level 1 certification. You can leverage our certification to obtain your principal license.

You don’t need to wait for third-party processor integration, PCI DSS audit, or infrastructure setup—we provide you with a ready-to-go solution.

As a technological partner and business advisor we manage comprehensive solution delivery tailored to your local market and business model.

Integration projects with payment schemes involve preparing numerous documents, including compliance papers, SLAs, and merchant contracts, usually taking 6-7 months. During this time, you'll incur Principal or project fees. We manage the process ourselves and reduce the launch time to 3 months, so you can start seeing returns faster.

White-label payment gateway and Acquirer processing services—all under one provider. Create MIDs and TIDs independently, without interaction with the processor’s team.

Manage merchants with custom contracts, smart fees, fraud tools, reporting, and access control.

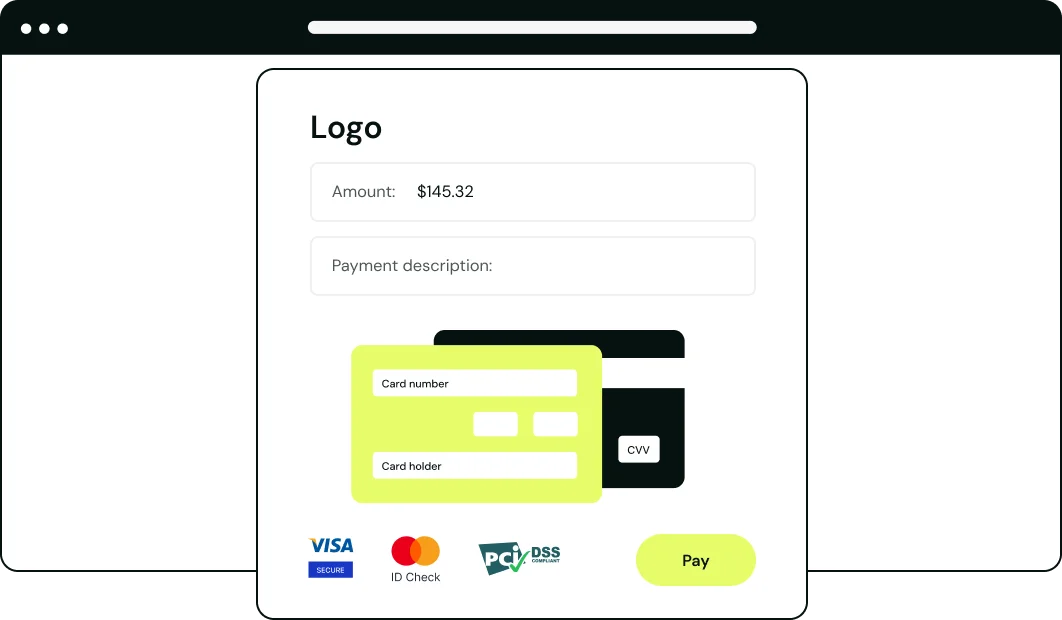

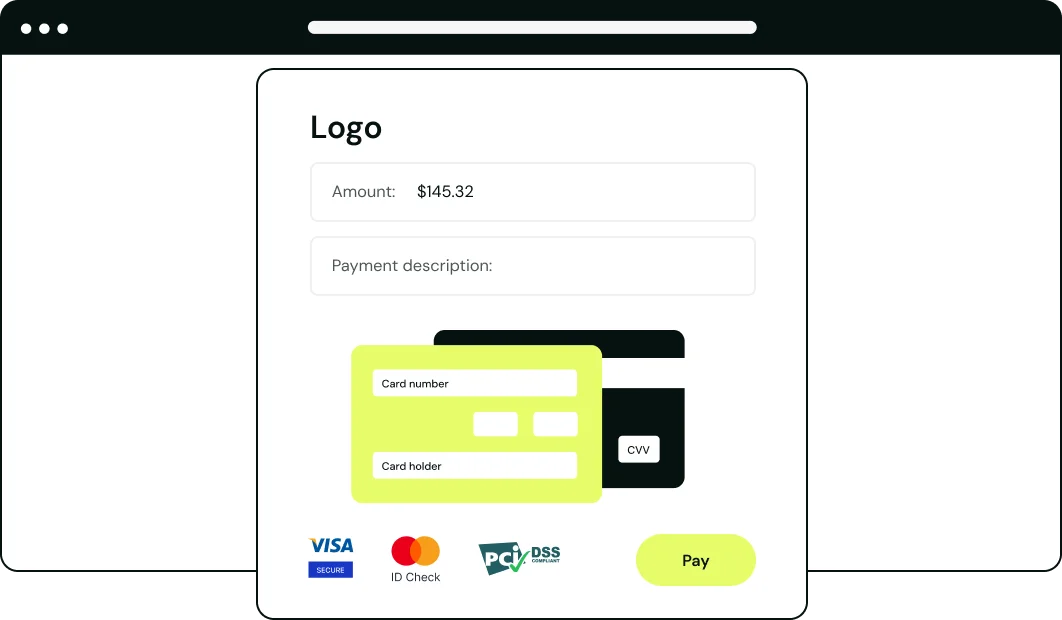

Payment links, RESTful API, multi-country support, recurring payments, and much more

We deliver clearing and settlement files, BIN tables, fraud and dispute insights, exchange rates, and IRD updates straight to your data storage.

We ensure timely merchant acquiring software compliance with all new payment scheme mandates.

Complete identification, screening, MID/TID setup, and merchant access provisioning within a day—with no manual effort.

Enable micro and small merchants to accept payments without specialized hardware, while offering them seamless omnichannel payments.

SoonWhether you choose to use any of our products individually or prefer an all-in-one white-label acquiring system, we will make sure that your requirements are fully met, with nothing unnecessary.

Book a demoIf you’re entering the market, choose a turnkey acquiring software with Neolink as your exclusive processor.

We help you replace your gateway or migrate from self-hosted to PaaS, ensuring a smooth transition and minimal disruption.

We can integrate our gateway with your existing or local provider, and also enable multi-processing for routing transactions and reduce risks.

Whether you’re looking to open accounts, issue cards, or provide mobile banking we’ll help you implement the necessary technologies.

We work with you to fully understand your objectives and design the ideal Acquirer software configuration, tailored to your long-term growth.

We implement and configure the software, set up a branded payment page on your domain, and personalize your merchant portal.

We enable seamless interaction between gateway and processing software, test live transactions, and facilitate integration projects with schemes.

After launch, we provide knowledge transfer, dedicated helpdesk support, monthly updates, hotfixes, and custom development services as needed.

We’ve got you covered, whether you need SaaS-based business software or prefer to host it on your infrastructure for complete control.

Book a demoWe manage infrastructure maintenance and updates of the payment platform. However, you’ll need an operational engineer to handle merchant onboarding and provide ongoing support for your clients.