Integrated KYC & AML automation platfrom

Merchant management system (MMS)

Make it easy for your clients to get started and gain full transparency of their activities. Manage merchants, customize contracts, track transactions, and monitor balances – in one plug-and-play system.

KYC & AML platform

Merchant self-onboarding

Customer due diligence

Cross-platform integrations

Privacy and Security are interwoven by design

GDPR

COMPLIANT

WL payment gateway provider portal

Contract & Tariff management

Scoring anti-fraud and limit engine

Settlements & Reconciliations

Financial accounting

Merchant analytics

Design any KYC onboarding flows, due diligence thresholds, pricing plans, and reports — with no limitations.

Significantly reduce manual efforts, errors, and paperwork — from customer support to AML procedures.

Manage relationships with clients in a fully digital omnichannel environment — from online onboarding to continuous monitoring.

Build a single source of truth about your merchants and sync data across your entire business ecosystem in near real time.

No IT resources required — we’ll deploy the solution in a managed private cloud, set up all integrations and workflows, and train your team.

70%

Less onboarding costs

90%

Fewer errors

We offer two fully integrated products to cover your entire merchant management — KYC & AML

platform and a white-label payment gateway provider portal. Use them together or separately.

Run customer due diligence at onboarding and during ongoing monitoring — with sanctions, PEPs, watchlist screening, custom scoring models, multi-tool risk checks, and automated decision thresholds.

We integrate with external systems for identity verification and screening — including Ondato, LexisNexis, Visa VMSS, and Mastercard MATCH — enabling multi-layered, region-specific compliance checks.

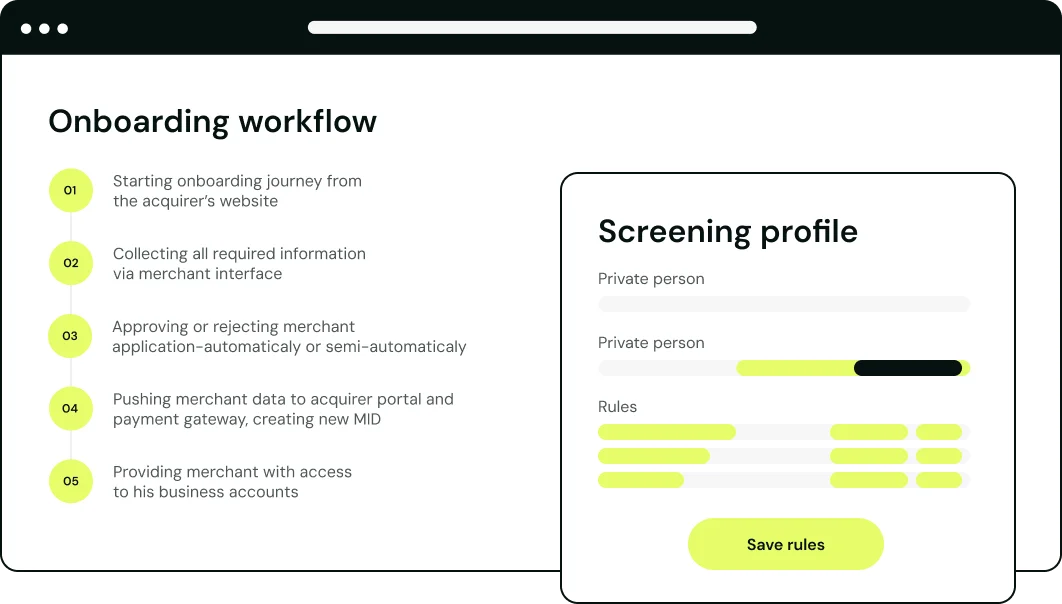

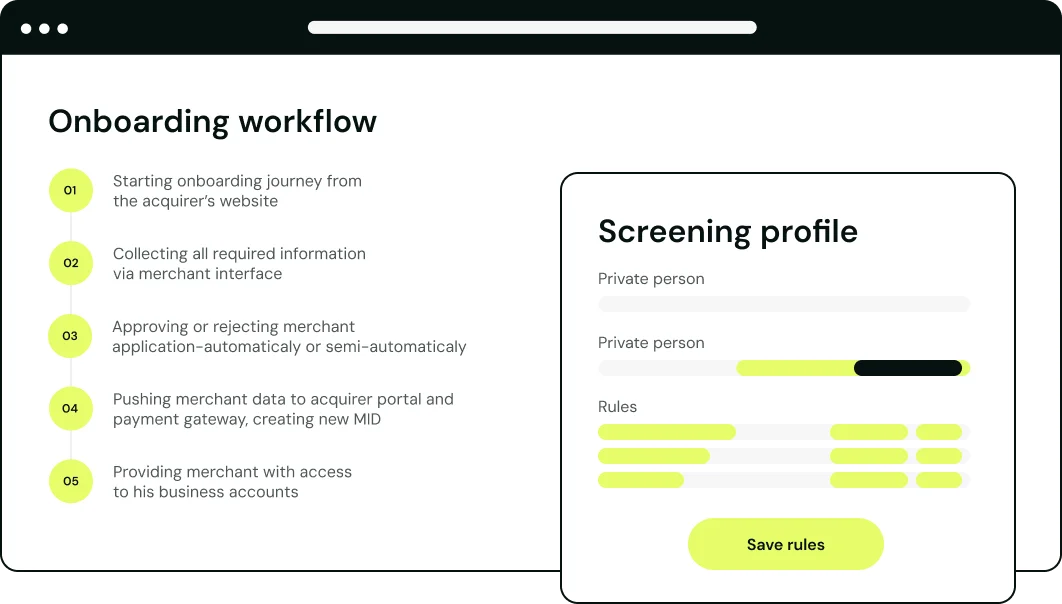

Onboard merchants through any touchpoint — web, mobile, or email — with fully customisable, personalised, high-conversion application forms. Support any type of identity verification, guide merchants via live chat and email

MIDs and TIDs are automatically generated after merchant self-onboarding and instantly appear in your gateway and processing portals. Merchant data (Master KYC records) is collected in our centralised merchant management

87%

Faster onboarding

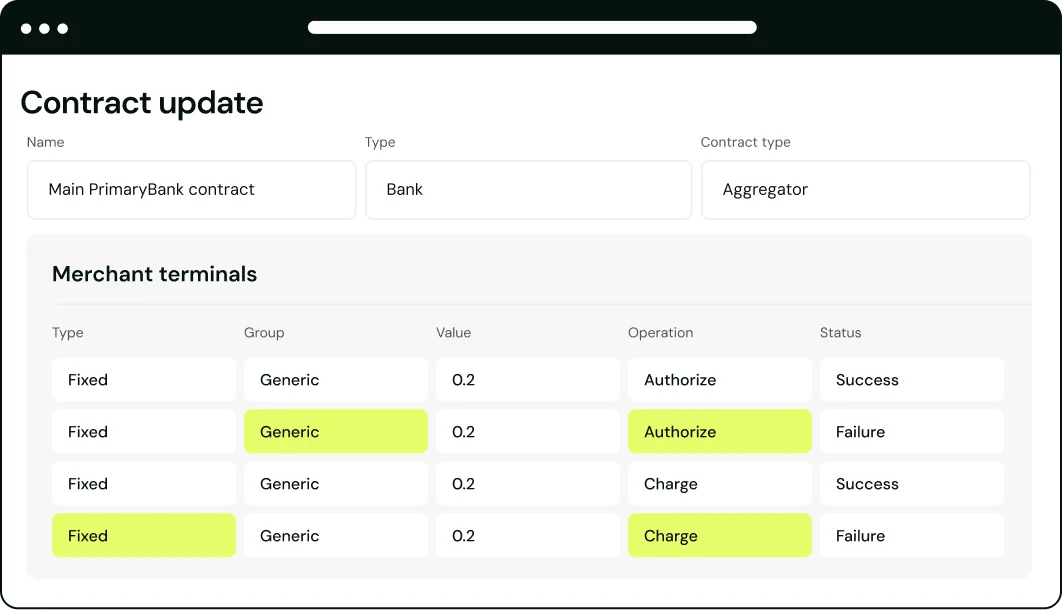

Enable subscriptions for merchants in minutes with pre-configured contract templates, then customize terms at any time — from individual rates and fee limits to automated contract updates. Manage provider and merchant agreements,

Automatically apply AML checks with scoring rules and anti-fraud limits tailored to your risk policy. Configure individual rules for merchants, control payment thresholds, and monitor turnover limits per card or client.

Gain full visibility and control over balances, settlements, and cash flow — from provider payouts to merchant receivables. Automate reconciliation across projects, currencies, and payment methods using two-sided matching.

Gain full financial control with real-time profit tracking, automated receivables/payables accounting, double-entry logic, and customizable charts—plus seamless file uploads and detailed reports for providers, merchants, and cash flow.

Track business performance in real time with clear, visual dashboards for both you and your merchants. Monitor transaction volumes, approval rates, failure reasons, issuer geographies, and more — to support faster, data-driven decisions.

If you’re entering the market, choose a turnkey merchant management solution with Neolink as your primary acquiring software vendor.

We can integrate with any gateway via API to unlock advanced onboarding, screening, and ongoing monitoring capabilities — without rebuilding your infrastructure.

We help you replace your ecosystem or migrate from self-hosted solution to SaaS-based, ensuring a smooth transition and minimal disruption.

Whether you choose to use any of our products individually or prefer an all-in-one merchant services management solution, we will make sure that your requirements are fully met, with nothing unnecessary.

We assess your business needs, compliance requirements, and technical landscape to design an optimal configuration of our KYC middleware and payment gateway.

We deploy the solution in a managed cloud, configure onboarding flows, merchant portals, and branded payment pages — fully aligned with your operational model and branding.

We connect external KYC providers, merchant apps, and internal systems like CRM, core banking, and processing platforms. All data flows and onboarding scenarios are tested in real-time.

We finalise automation of onboarding, risk logic, and settlement rules, support your team through launch, and provide continuous updates, support, and customisation as needed.

We’ve got you covered, whether you need SaaS-based business software or prefer to host it on your infrastructure for complete control.