Expert IT support and business advisory

services for licensed financial entities

Neolink provides a comprehensive tech infrastructure for Acquirers and PSPs, empowered with turnkey IT services. Overcome hurdles in launching or upgrading your payment business with our expert guidance, from regulatory compliance to financial license consulting.

Get in touchBoost agility with our groundbreaking

approach to paytech solution delivery

No IT hassle on your end – we handle all the tech

We enable you to fully outsource the technology aspect of your business, handling white-label product deployment and branding or developing custom features and UIs.

Infrastructure-as-a-Service

We manage your entire backend and frontend infrastructure, ensuring data security with isolated servers. The API-first architecture offers the flexibility to add new features and unique UIs.

Unlike dealing with SaaS or API platforms, you gain access to highly customizable products, private cloud infrastructure, and dedicated IT department.

Utilizing plug-and-play ecosystem or standalone products

Regardless of your business development stage or technology needs, you’ll have access to exactly what you need, without overpaying for unnecessary features or duplicating functionality.

FinTech consulting services throughout all key stages of your business development

This glue unites our solutions, tailoring them to your needs and helping you bridge gaps in expertise, so you can avoid stress, save resources, and stay focused on your goals.

A unified ecosystem of

powerful software

White-label

payment gateway

Acquiring Platform-as-a-Service

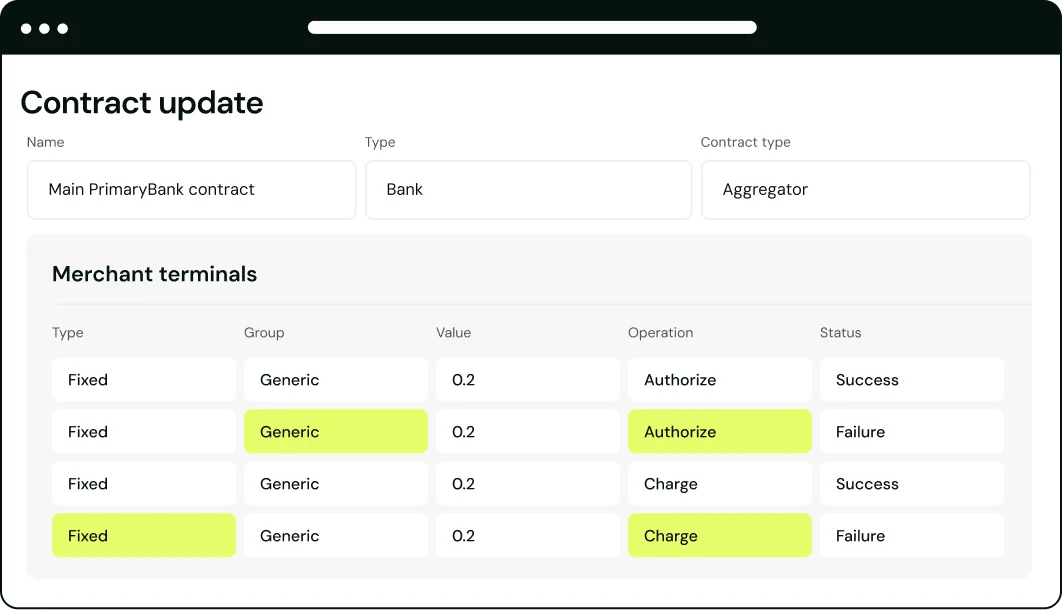

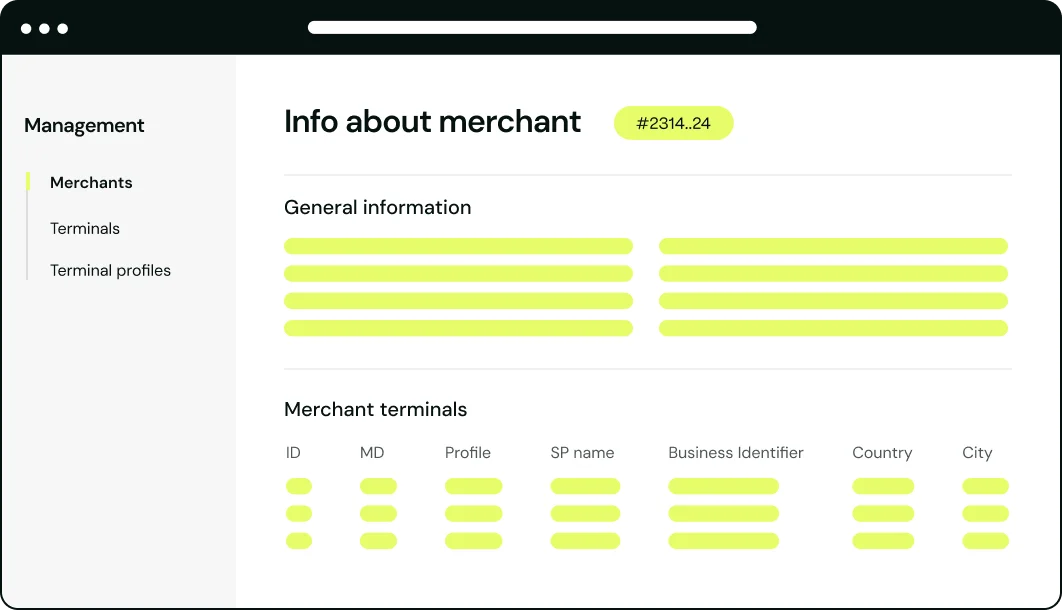

A comprehensive cloud-hosted acquiring payment gateway with client-facing applications and complete back-office functionality for Acquirers and PSPs.

Learn moreThird-party Visa &

MC processor

Acquirer processing services

A third-party tech solution between the Acquirer and card schemes, functioning as either a primary or backup option, seamlessly integrated with any gateway.

Learn moreSelf-onboarding and

ALC management

KYC & AML automation platform

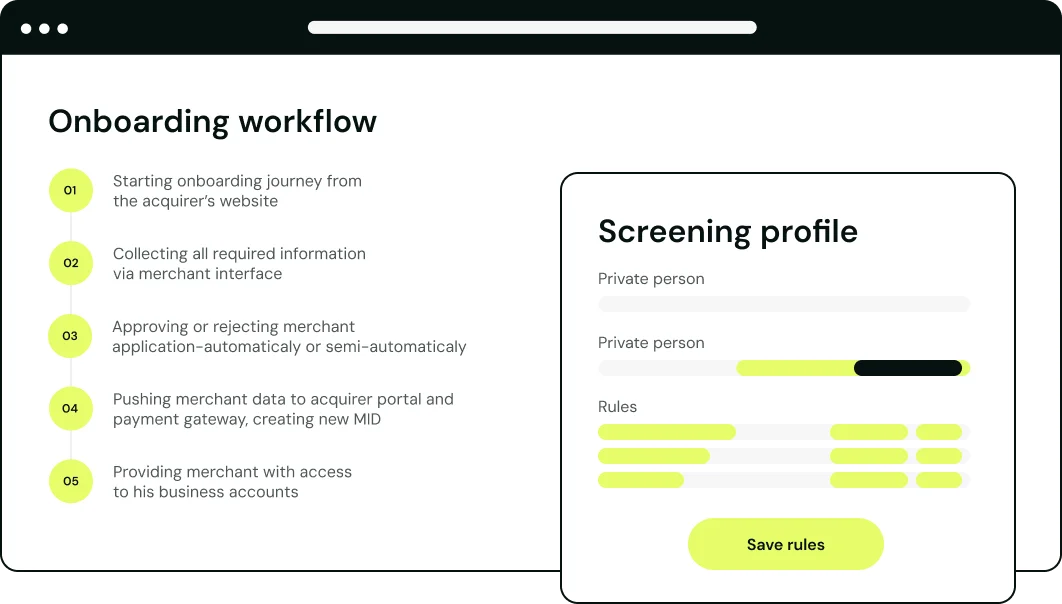

Client self-onboarding and lifecycle management solution, enabling you to accelerate identity verification, watchlist screening scoring, and account access provisioning to just a day.

Learn moreRely on professionals supporting

you lock, stock, and barrel

We refine value proposition and business strategy for fintechs, help with building effective go-to-market strategies, and design products that resonate with your target audience.

Additionally, we offer expert compliance guidance across the UK, EU, MEA, and APAC supporting startups and businesses at every growth stage.

Discovery, custom setup, seamless integration with gateways, payment schemes, and existing banking infrastructure, and data migration–Neolink’s fintech consultants cover each step.

Once your solution is launched, you’ll get dedicated software support, regular updates, and custom development. Our end-to-end process gets you market-ready faster while setting the foundation for scalable growth.

Keep your fintech solutions on top of the market with our capabilities to integrate anything you need: payment processing and fraud detection features, checkout solutions, alternative payments, and more.

Our tech consultants will help you pick the right features based on your request, supporting you with expert knowledge and fast implementation on a turnkey basis.

For Acquirers we serve as a third-party processor we manage the Visa/Mastercard integration projects by handling all steps: compliance, SLAs, and merchant contracts.

You’ll get a reduced launch time from ±6 months to just 3 months. Best part: it’s all hassle-free for your business, as we know the drill.

Staff training on product use and preparation for merchant onboarding. You’ll get a dedicated success manager for personalized support, financial technology consulting, and advisory.

If you’re working with Acquirer processing, we deliver daily assistance and swift resolution of critical issues to ensure reliability and ease-of-use with our products. You won’t be left alone: we’re always here to help.

Neolink’s engineers and designers will help you create a market-winning solution that supports your business and provides a stunning experience for your clients.

Enhance your business capabilities with tailored client-facing products and build all essential banking infrastructure functionalities with top-tier integration, scalability, and innovation.

years of experience launching products

payment providers we’ve helped

Let’s find the right solution for you

Contact usOur deep understanding of Acquirers’ and PSPs’ business processes and regulatory requirements allows us to significantly reduce go-to-market timelines and save clients tens of thousands of dollars. As a technology-driven company with a scalable team of world-class engineers, each with 10+ years of experience, we deliver tailored solutions for even the most demanding projects.

Dive into a tailored solution powered by our

business support services

Turnkey Acquirer

Handling your entire acquiring ecosystem and providing seamless Visa/Mastercard integration for a hassle-free launch.

Acquirer in emerging markets

Covering all IT requirements tailored to your needs and providing on-demand expertise and guidance for your success.

Turnkey PSP

Providing gateway configuration, provider connections, and everything needed for your financial infrastructure.

Put the best

opportunities to work

for your acquiring

business now

We’ve got you covered, whether you need PaaS-based business software or prefer to host it on your infrastructure for complete control.

Book a demo