An acquiring

business ecosystem

as a service

for financial license holders at any stage

of their journey

White-label Acquiring Platform

For Acquirers and PSPs

Acquirer technical processing

For Acquirers

PCI DSS Level 1

certified cloud infrastructure

We manage the core tech needs of acquiring service providers, delivering IT advisory and turnkey cloud solutions that seamlessly link the entire chain — from merchants to card schemes.

A one-stop shop

for principal members

No IT developers necessary

We handle all tech issues of your payment infrastructure with our acquiring ecosystem solutions. No need to worry about PCI DSS, integrations, testing, or custom features.

Launch times cut by two-thirds

Acquirer processing launch is completed in just 4 weeks. The comprehensive business ecosystem for acquiring services will be established within 3 months.

Lowest capex and opex

Get a complete acquirer payment platform launched on our cloud-based infrastructure for just €50,000, with processing costs 80% below market and no hidden fees.

United gateway & processing

You’ll deal with only one contractor and pay a unified fee for the payment ecosystem. We ensure turnkey launches from scratch and easy transitions from legacy systems.

90days

Launch time from

€50k

Launch cost as low as

Processing

Primary Acquirer processor

Backup Acquirer processor

A launchpad to start as a PSP and

smoothly transition into an Acquirer

Turnkey PSP solution

PSP to Acquirer transition

Opportunities

Business model flexibility

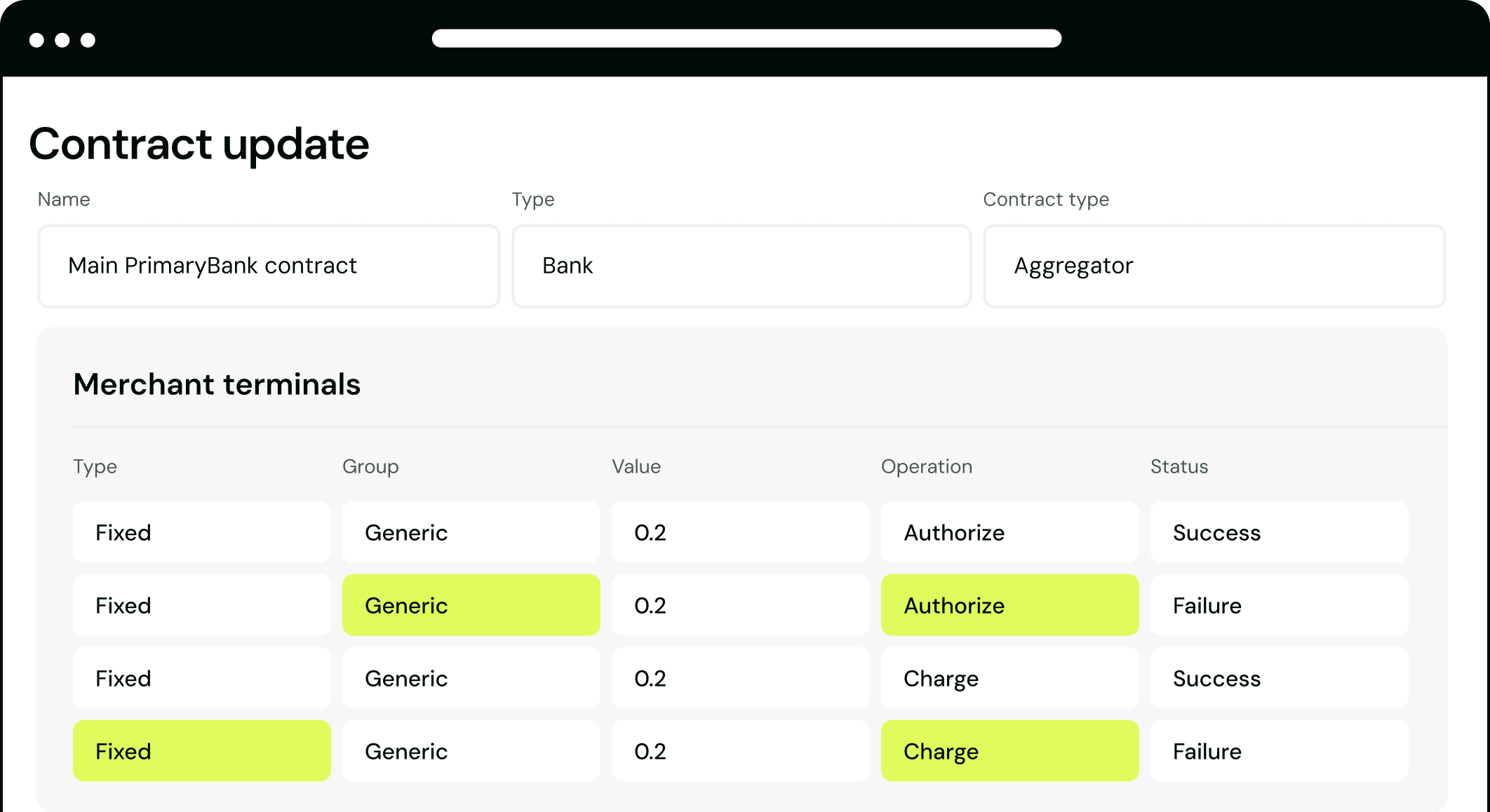

SaaS no longer means vendor lock-in. Integrate without limits and create provider networks, route transactions, and manage merchant plans on your terms.

Effortless evolution with no extra costs

Gradually upgrade your licenses while continuing to use the same software. You won’t have to migrate or pay extra for acquirer features.

Let’s find the right solution for your merchant service business

Whether you’re obtaining licenses and need a comprehensive acquiring-as-a-service ecosystem with full support, or looking for business optimization opportunities, we’re here to help.

A unified ecosystem of powerful

software and services

Acquiring Platform

WL gateway

A comprehensive cloud-hosted acquiring payment gateway with client-facing applications and complete back-office functionality for Acquirers and PSPs.

- Provider back-office

- Customizable payment page

- White-label merchant portal

- RESTful API

- Loyalty engine

- Payment processing core

Acquirer processing

Third-party service

It works as a primary or backup solution, seamlessly integrated with any gateway. For the ultimate setup, opt for an integrated solution with our Acquiring-as-a-service Platform.

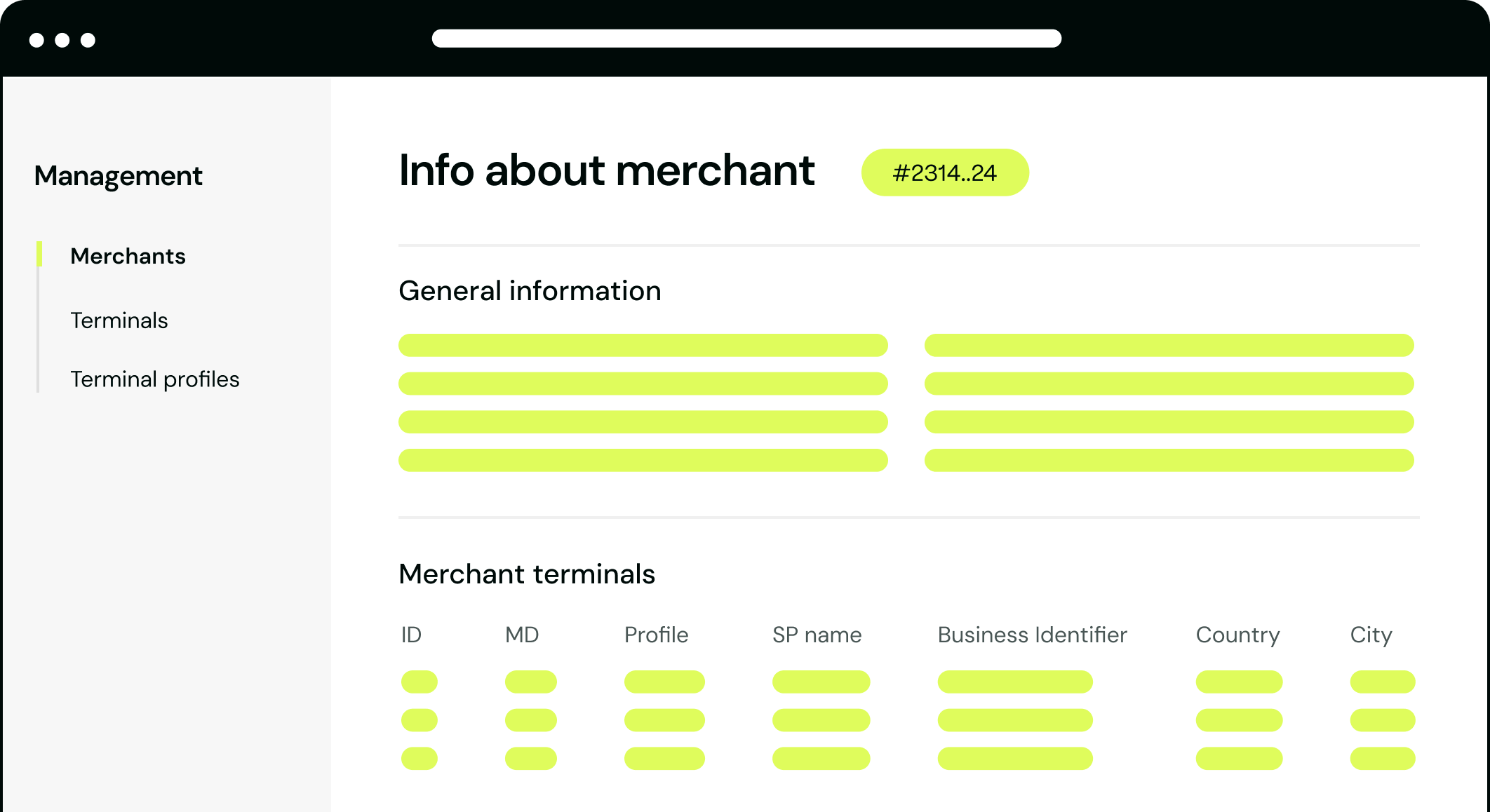

- High-load processing

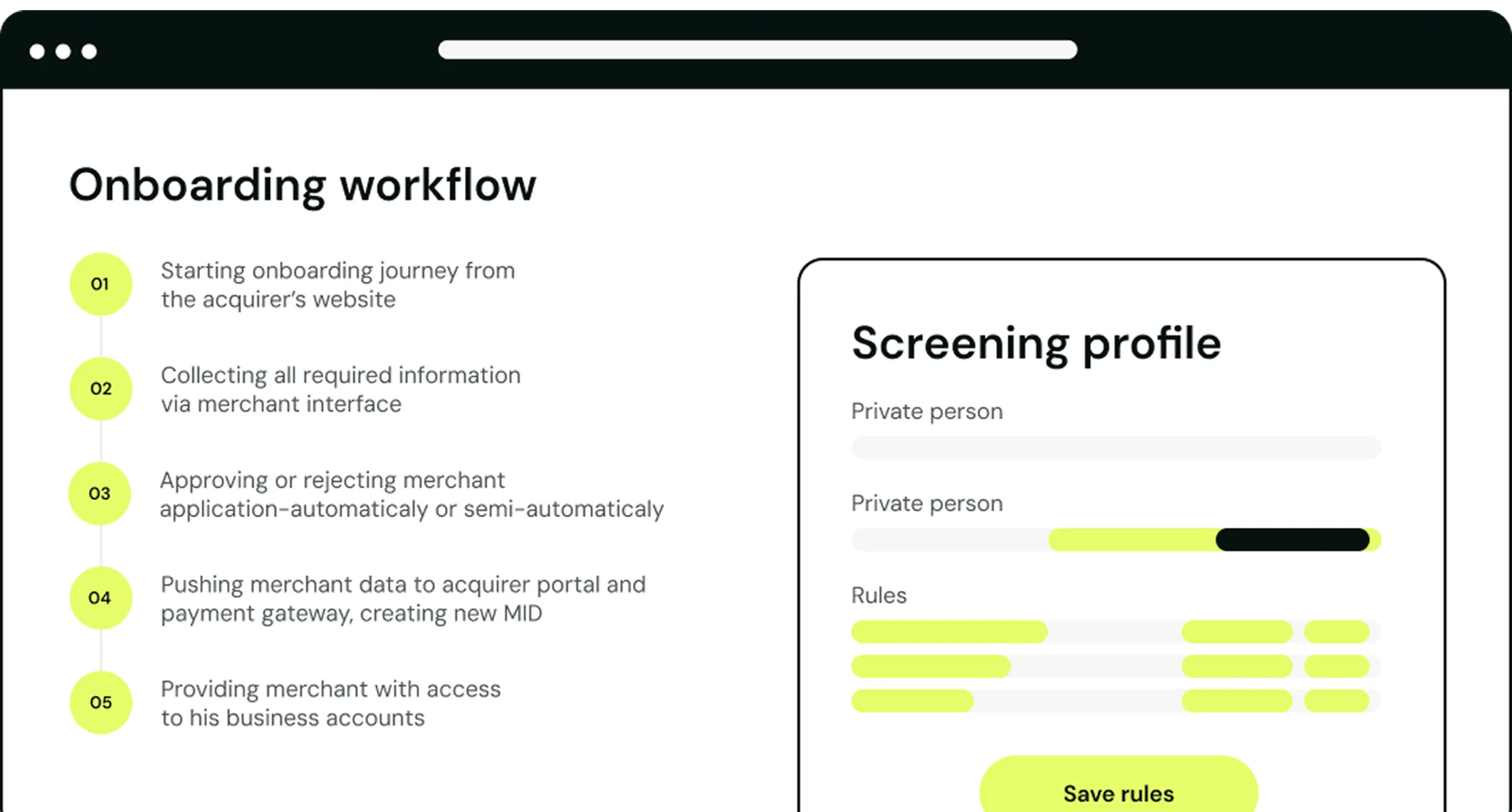

- Independent merchant onboarding

- Issue resolution services

- Automatic report uploading

- Acquirer back-office

- Detailed transaction tracking

KYC & AML automation platform

Client life-cycle management

A fully integrated middleware that connects third-party tools for client identification and screening with your business systems, consolidating everything around a single client profile — the Master KYC record.

- KYC and KYB onboarding

- Customer due diligence (CDD)

- Customer data platform (CDP)

Expert business support

FinTech consulting

Business guidance is a crucial part of our acquiring ecosystem as a service. We’ll help you overcome obstacles, like integrating with schemes or adapting to regional regulations, fast and cost-effectively.

- FinTech strategy consulting

- Payment scheme integration project management

- Turnkey launch and integration

- Custom development

See what our clients say about the results

of our collaboration

Thanks to Neolink, we not only obtained the software necessary to launch our acquiring offering but also gained a trusted technology partner. Their experts provided invaluable guidance through multiple stages of our business transformation — streamlining the complexities of compliance, scaling and maintenance, effectively removing obstacles and swiftly resolving bottlenecks.

Roman Loban

Managing Director

FMPay

Let’s figure out what products are best for your specific case

You can use any of our products independently or choose a turnkey ecosystem integration option. We’ll ensure that your needs are fully addressed, with nothing unnecessary.

Next-gen capabilities

for predictable business growth

Fault-tolerant scalable IT infrastructure

We guarantee data security and flexibility to scale up or handle temporary spikes. Financial institutions of any type use our PCI DSS Level 1 Certification.

- High-performing AWS infrastructure

- Setup on an isolated private cloud

Back-office reducing business cost

Say goodbye to business platforms that don’t meet real-world needs. We’ve learned from dozens of acquirers to create an acquiring-as-a-service platform that cuts manual work by up to 60%.

- Automated KYC/AML onboarding

- Automated accounting reports

Future-ready payment features

No more asking vendors for innovation. We continuously integrate next-gen features into our payment processing platform for acquiring at no extra cost.

- Omnichannel payments

- Open banking

- Google Pay, Apple Pay

- AFT, OCT payouts

- High-risk payments

- Multi‑currency

- Tokenized transactions

- Multi‑country

Competitive products for your clients

There’s no restrictions on attracting and retaining clients with our business ecosystem for payment acquiring. Deliver your unique value to the market while we handle development issues.

- Custom web or mobile UIs

- Customizable white-label apps

Fast and simple integrations

We’ll connect your business software with any third party paytech—whether it’s an acquirer, payment provider, processor, or app—in just 3 weeks. You don’t have to settle for a limited list of connectors.

€0

Extra for innovations

60%

Less manual work

3week

Integration

Put the best opportunities to work for your acquiring business now

We’ve got you covered, whether you need PaaS-based business software or prefer to host it on your infrastructure for complete control.